The author’s views are entirely his or her own (excluding the unlikely event of hypnosis) and may not always reflect the views of Moz.

There are over 22,600 software-as-a-service (SaaS) companies in the world right now, according to Crunchbase.

On Capterra, there are more than 800 software categories.

Research by Statista indicates that the market size of the SaaS industry has grown from $5.56 billion in 2008 to over $156 billion in 2020.

What do these figures show? It’s simple. The SaaS industry landscape is becoming more competitive by the day.

To stay on top of your game as a SaaS business, you must identify the companies you’re competing with from an SEO standpoint. That way, you’ll know the content strategies to focus on, the keywords to target, and the type of backlinks to acquire. In this post, you’ll learn three effective ways to do this quickly.

Why care about your SEO competitors as a SaaS brand?

If you don’t know your SEO competitors, you’re leaving so much on the table, while they occupy the top spots on the SERPs.

1. You can identify the top keywords they’re targeting and how they’re acquiring backlinks to help your own strategies.

By identifying the companies competing against your SaaS brand, you’ll know the top keywords they’re targeting. That way, you can focus on those keywords that can generate qualified traffic and drive user signups for your SaaS. This streamlines your keyword research process.

Knowing your top SEO competitors is also a great way to perform a link gap analysis. That way, you can know the type of backlinks they’re acquiring and where they’re getting them from. This helps you to identify relevant websites that are more likely to link to you.

2. You can figure out the competitive edge you have over them

If you don’t know who your top competitors are, you won’t be able to find the SEO opportunities to focus on to drive growth for your business.

Take, for instance, if they focus more on high-volume, top-of-the-funnel keywords. If you then go after middle- and bottom-funnel keywords, it could give you a competitive edge.

3. You can understand their biggest drivers of growth and conversion.

Most SaaS companies optimize their blog posts, landing pages, and product pages for conversions. This is because they measure growth by the number of signups and paying customers that they have.

By identifying your SEO competitors, you can know the kind of CTAs and buttons that work well in your niche. That way, you’ll have a better understanding of the conversion strategies that can drive growth for your SaaS business.

Three ways to identify the SEO competitors of your SaaS brand

Here are three tactics you can try today to identify your SaaS brand’s top SEO competitors.

1. Use SEO tools

SEO tools have access to large amounts of data for different websites and niches — and they’ve analyzed and categorized this information for your own use.

For example, SEMrush has the Market Explorer tool, which helps you to find potential competitors for your business. Ahrefs also has a competing domains report in the Site Explorer tool. This helps you to identify the websites competing with your SaaS, based on the kind of keywords you’re ranking for.

You can also use the Moz Pro True Competitor tool to identify the top SEO competitors for your SaaS brand. Here’s how it works: Let’s say you want to identify the top SEO competitors of Moz. With this tool, you can find that information within a few seconds.

The first thing you need to do is enter the following details in the tool:

-

Preferred market: The specific location you’re targeting

-

Domain type: The type of domain

-

Domain name: Your website URL

Once you enter this information and hit the “Find Competitors” button, you’ll get a list of top 25 competitors:

As you can see, websites competing with Moz on the SERPs aren’t limited to software brands alone. They include others such as:

-

Google

-

Search Engine Journal

-

Hubspot

-

Search Engine Land

-

Wordstream

-

Backlinko.

This tool also has the Overlap and Rivalry metrics, to filter your top competitors.

The Overlap metric filters your top competitors based on the shared keywords you both rank for on the first page of Google. The Rivalry metric uses factors like CTR, DA score, the volume of shared keywords, etc. to identify the most relevant competitors for your SaaS.

After identifying your top SEO competitors, you can perform an in-depth analysis of at most 2 of them, to know the keywords they’re targeting.

2. Survey or interview your new and existing customers

If someone signs up for your SaaS product, chances are that they’ve demoed or tried out other options before deciding to go with yours. It’s also possible that they’ve just churned from one of your competitors to become a customer.

This shows that they have an idea of who your direct and indirect competitors are. To get this information, all you need to do is reach out and interview them one after the other. This could be by talking to them via a quick call, sending a short survey for them to fill out, or asking them during the onboarding process.

Here are some questions you can ask customers to identify your top competitors:

-

What tools were you using to [solve X problem] before trying out our product?

-

If you’ve never used any tool before, how were you able to solve this problem before now?

-

What made you interested in trying out our product?

-

When did you realize that a tool like ours is what you need right now?

-

How much research did you do to decide on our product? What are some other, similar tools you discovered during the research process?

3. Perform a Google search targeting your SaaS use cases and features

Performing a Google search for the use cases, features, and problems your software solves is a great way to identify your top SEO competitors. This is effective because most companies ranking high on Google are investing in SEO.

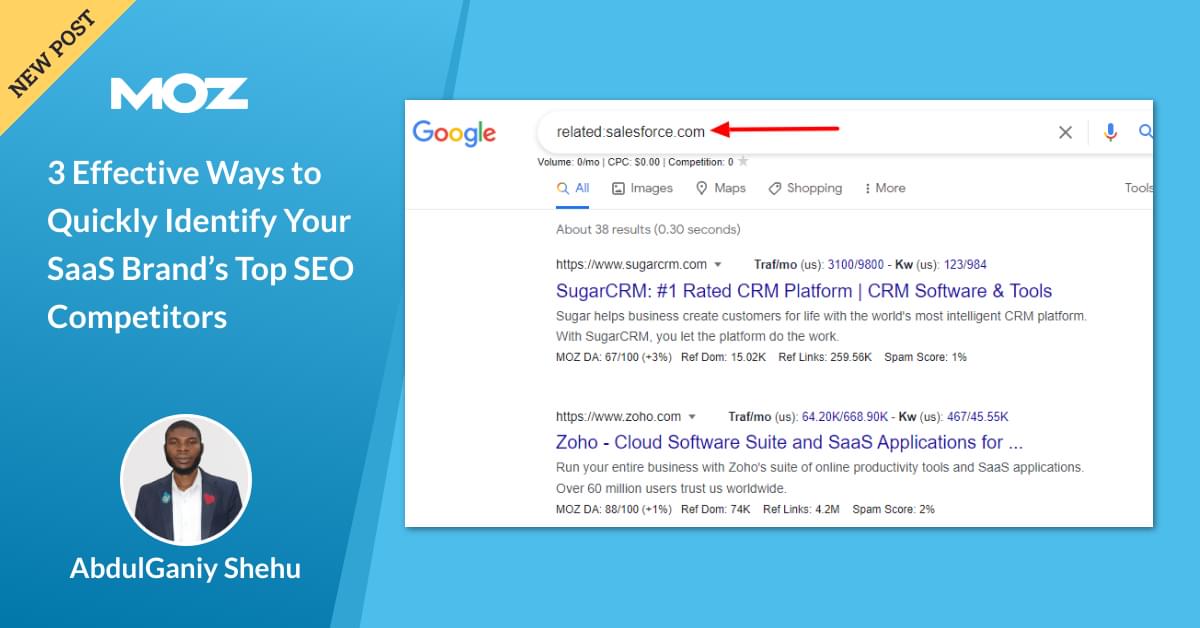

Use the “related:website” advanced search feature

This search operator shows you other websites related to the one you search for on Google.

Let’s say you want to find websites like salesforce.com. You can search for “related:salesforce.com” on Google. The results on page one are some of SalesForce’s top SERP competitors:

Search for the use cases of your software

If your software helps SaaS companies onboard and activate new users, one of your core use cases is “user onboarding”.

If you search “user onboarding software” on Google, you’ll unlock competitors who are either bidding for or ranking organically for the keyword.

Some of the websites targeting this use case on Google include:

-

Appcues

-

Userpilot

-

Apty

-

Userflow

Aside from that, there are SaaS brands paying to rank on the first page of Google for this keyword.

Search for your SaaS features

One of the core features of the Moz tool is the “rank tracking” feature. To identify the websites that have a similar feature, you can input that keyword on the Google search bar.

Here’s the result it returns:

As you can see, aside from Moz, other competing websites for this feature include:

-

Link-Assistant

-

Ahrefs

-

Rank Tracker

-

Spyfu

-

SEMrush

Search for your SaaS jobs-to-be-done (JTBD)

Let’s say you run an online video editing software, one of the problems that your audience most likely have is “how to add an image to video”.

By performing a Google search for this query, you’ll see a result that looks like this:

This shows that some of the top SEO competitors in the online video editing space include:

-

Kapwing

-

Veed

-

Online Video Cutter

-

Flixier

-

Movavi

Conclusion

If you don’t know the SaaS companies you’re competing with, they’ll leave you behind and dominate your niche.

In this post, you’ve learned three effective ways to identify your top SEO competitors as a SaaS brand:

-

You can use an SEO software such as the Moz True Competitor tool to find your competitors and know the keywords they’re targeting.

-

You can reach out to new and existing customers, to find out the solutions they’re comparing you with.

-

You can search Google for your SaaS product’s features and use cases. This shows you the companies likely competing with your brand on the SERPs.

Ever tried any of these tactics before? Kindly share which of them worked really well for your SaaS brand in the Q&A.